Bombardier Recreational Products was originally a subsidiary of Bombardier, until 2003 when the Recreational Products Division of Bombardier Inc. was spun-off and sold to a group of investors.

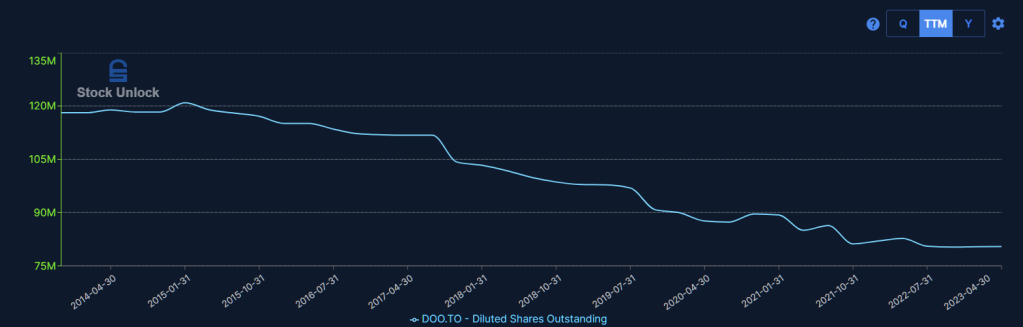

Ten years later, BRP was taken public with an IPO priced at $21.50/share. Share count started around 120,000,000 and is now around 80,000,000. The cannibalizing of shares only really began in 2015, and since then shares have decreased by almost 5%/year, while paying out a low (0.7% on average) dividend.

What do they do?

You know this company, even if you don’t know the name BRP. They own the Sea-doo and Ski-doo brands, as well as:

- Lynx, a higher-end snowmobile brand

- Evinrude, a boat parts and accessories manufacturer

- Rotax, a powertrain manufacturer, whose engines are used in all of BRP’s vehicles.

- Can-Am off-road (ATVs) and Can-Am on-road (3-wheeled motorcycle things and electric motorcycles),

- Alumacraft (boats with a fishing focus)

- Manitou (pontoon boats)

- Quintrex (all sorts of boats in Australia)

While market share numbers aren’t totally clear, Sea-doo has a huge chunk of its market, probably something like 35%, and competes mainly with Kawasaki (Jet Ski) and Yamaha (Waverunner). Kawasaki’s offerings are all around $25,000 while Sea-doo has a wide range from a minimum of $6000 to a maximum price of $19,599. Yamaha’s low end models start around $13,000 and go all the way up to $28,000. (Maybe I’m biased as a Canadian but I actually call these personal watercraft sea-doos, same thing with ski-doos)

Ski-doo absolutely dominates the snowmobile market, with what some sources are claiming is up to 60% of the market. They compete with Polaris, Arctic Cat and Yamaha.

Can-Am ATVs mainly compete with Polaris, Honda, Textronic and Yamaha, with probably something like a 10-15% market share.

The company also recently acquired an 80% stake in Pinion GmbH, a manufacturer of gearboxes and electric bicycle motors, “to allow the company to pursue its growth strategy with low voltage [e-bikes] and human assisted [bicycle] product categories at the intersection of mobility, recreation and utility.” They created a new group in BRP called “LVHA” (low voltage, human-assisted) and no doubt intend to at least enter the electric bicycle market.

Financials

ROIC is currently sitting around its 7-year low, and it’s still a fantastic 34% currently. The lowest this number has been since the company went public is 21%. The average is 40%. That’s incredible. From this, revenue has grown at a CAGR of 14% and revenue per share has grown at 18.7% due to the buybacks, all while still paying out a small amount of excess capital. EPS has compounded at 30% over this period.

In the balance sheet (as of April 30, 2023), the important current assets are $213M of cash, $586M of receivables and $2500M in inventory (roughly 1 quarter’s revenue of inventory – a nice well managed amount. Although it’s worth noting that BRP does not hold their inventory on the balance sheet at expected selling cost, it’s held at “the lower of weighted average cost or net realizable value”) non-current assets have $1867M of property, plant and equipment, $738M of intangibles, and $179.7M of right of use assets.

In terms of liabilities, the company has $91M of current debt, $1603M in accounts payable, and $617M in provisions mostly for losses related to warranty coverage on vehicles sold. The company also has $2772M in long-term debt.

This level of debt is not too concerning, although interest costs in Q1 2023 were up to $43M from $16M, (net income was $154M so interest payments were like 28% of net income) while the debt levels barely changed so there’s definitely some amount of interest rate exposure/risk here. Still, it’s a pretty manageable amount.

On the most recent income statement, revenues were $2429M, with a gross profit of $623.5M (25.6% margin). Selling & marketing were $127M, R&D were $101.7M, general and admin were $98.8M. With other operating expenses of 13.6M, operating income ended up at $282M (11.6% margin).

After taxes of 41.2M, interest of 44.3M, and a 43M loss from foreign exchange on long term debt, net income was 154M.

I’m inclined to ignore the 43M loss from foreign exchange on long-term debt. Most of BRP’s debt is in USD, and a small amount is even in euros. They are a Canadian business so a 1.5% 3-month fluctuation in USD/CAD can cause an artificial 43M loss. I’m going to add this back into earnings for valuation stuff.

Adding that number back in, 2022 EPS was $12.1. Stock-based compensation for the year was a measly $19.5M, or $0.24/share, so maybe $11.8 is closer. Based on this number, $DOO.TO is trading around 9x earnings at the moment (at a $108 stock price). This seems like pretty compelling value based on the growth and returns on capital we’ve seen since the company has gone public.

If we want to add in the net debt of ~$2.72B, it’s trading at an enterprise value to earnings ratio of about 12.5.

Cash from operations historically has been typically around 3x net income, however since 2020 inventory has been increasing drastically and this is causing OCF to be lower than net income by a small margin. This is mostly to offset increases in demand but also inventory margin has increased from around 18% to around 24%

Without this effect, operating cash flow for the 2023 would’ve been $1163M and FCF would’ve been about $510M.

The Industry

Returns in the powersport industry have historically been excellent. This is in stark contrast to a very similar seeming industry, automobiles, but there are some important differences which make powersports a much nicer industry:

First, there is significantly less competition. There are basically only 3 or 4 big brands in each of BRP’s main spaces, which gives BRP better pricing power.

There’s less innovation and it simply isn’t a cutthroat industry because while cars are necessities for a majority of the western world, BRP’s products are much more discretionary, and the addressable markets are much smaller. This makes the industries less “sexy” and fewer new entrants seem to be emerging. Also, y’know, you never really hear people talking at the bar about how they were restoring an old classic snowmobile.

BRP has announced that by 2026 they will have electric versions of all their products. This is certainly the future of pretty much everything BRP makes, and is also, I think, in response to new entrants like Taiga Motors and their electric snowmobiles and personal watercraft. Taiga ($TAIG.TO) has done about $5M in sales in the last year (with net income of -$63M somehow). They have a market cap of only $58M and just recently took on about 30M in debt. Doesn’t look like they’re doing too well but revenue is growing pretty fast so perhaps some day if it manages to become a profitable business, Taiga may be a threat to a piece of $DOO.TO. I think it’s a more likely however that by 2026, BRP’s electric lineup is doing substantially more in sales than Taiga.

If Taiga’s expenses are anything to go off, the next couple years will probably be more capital intensive for BRP than normal as they develop electric lineups across the board.

Where does future growth come from?

Based on my very quickly looking it up on google, analysts seem to expect the snowmobile, ATV and personal watercraft industries to grow around 5%/year. Not that I pay much attention to forecasts but it seems pretty reasonable that BRP can grow sales at 5% a year barring them losing substantial market share across the board but the business is pretty well diversified so I really don’t know how that can happen aside from something apocalyptic. How would you take down BRP? I think it would be really really tough. I think it would depend more on BRP making big mistakes and Yamaha/Kawasaki taking market share than on a new company like Taiga swooping in and pricing at 1/5th of their cost of goods sold.

The only major problem I’m seeing with BRP as an investment is that a lot of their growth in the last 10 years has been from them taking market share from their competitors. This cannot continue forever, and so eventually growth will slow to at least industry levels (5%ish). I think the expectation for the future should be that the majority of growth will come from acquisitions, integrating BRP’s engines/motors into other product types, as well as the continuation of buybacks. Expecting anything more is likely unrealistic.

The last important question, I think, is are they over-earning? And the answer to this one is.. well, maybe? I don’t exactly think so at the moment, as demand has been consistently higher each year since covid. Moreover, metal costs have been higher than average lately and are certainly normalizing now. I do, however, expect that demand could fall as mortgage interest rates start to catch up with homeowners. This is however a temporary concern and not really something I’d feel inclined to worry too much about as a long-term shareholder.

Since I don’t think they are over-earnings but really I don’t know, I’m just going to discount their current earnings by 20% before doing a DCF:

So that would give us an annual normalized EPS of 9.44, and assuming a 5% growth rate per share (after buybacks) for 10 years and my standard 10% annual discount rate, and a final P/E of 10, we get a current value of $125/share. I would like to buy at 2/3 of that, so a nice realistic buy target for me would be $83.84.

I think it’s very likely $DOO.TO will outperform my targets over the next 10 years, but that’s mostly my gut feel. I do not have a huge edge here so I think it’ll pay to be conservative. The stock traded at $20 in 2020, so it’s certainly not impossible we’ll see the $80s.

Just to note – if we decide they aren’t over-earning at the moment, my buy target would then be $104.8, very near where the stock trades now. I may decide this in the near future. But for now, it’s in the watchlist with an $83 target.

If you read this far, thank you. I deeply appreciate feedback so if you have any comments or opinions, please write it below or back on my Twitter!

I also just set up a donation page. If you feel so inclined you can now buy me a share $AEP.V, $SOM.L or $WBD here.

Leave a comment